How Hackers Emptied Church Coffers with a Simple Phishing Scam

The approach was simple, a combination email scam and social engineering phone call. All it took was a call to St. Ambrose Catholic Parish, claiming to be Marous Brothers Construction, a company working on a church renovation project for the past two months. But the phone call wasn’t from Marous Brothers Construction. The scammers told the church that payments were late.

A statement from the Saint Ambrose Catholic Parish’s Father Bob Stec said:

On Wednesday, Marous Brothers [construction] called inquiring as to why we had not paid our monthly payment on the project for the past two months totaling approximately $1,750,000. This was shocking news to us, as we have been very prompt on our payments every month and have received all the appropriate confirmations from the bank that the wire transfers of money to Marous were executed/confirmed.

The scammers convinced the church that the construction company they hired had changed their bank. Hindsight being 20/20, whoever received the call should have confirmed with another source. But they didn’t. Father Stec explained:

Upon a deeper investigation by the FBI, we found that our email system was hacked and the perpetrators were able to deceive us into believing Marous Brothers had changed their bank and wiring instructions. The result is that our payments were sent to a fraudulent bank account and the money was then swept out by the perpetrators before anyone knew what had happened.

According to the FBI, the criminals breached the church’s email account, then began a waiting game during which the hackers sat back and read all of the conversations in the inbox. Eventually, they were able to glean enough information to convince the church to wire them money. Before the church realized, it was out $1.75 million in the middle of a major renovation, and all it took was a few emails, some Photoshop skills, and a phone call to derail the good intentions of the parish.

Protect Thyself: Even the Sacred Are at Risk

In 2019, even a cyberattack on a church shouldn’t surprise anyone. According to the FBI, cybercrime losses doubled in 2018 over the previous year. It wouldn’t be shocking, based on trends, for 2019 to up the ante even further. With cybercrime prevention all over the news, more individuals and organizations are realizing that they must get proactive at protecting themselves; this story should serve as a warning to all organizations, even those not operated for profit or that are religiously affiliated.

A good first step is to shift your security strategy from cybersecurity to cyber resilience, which is essentially a change in emphasis from reactive to proactive. The important point is not to be intimidated by the universe of potential security processes, tools, and strategies. Start with a few simple things.

- Be brilliant at the basics. Simply put, this means doing the small things right, such as staying on top of routine maintenance such as patches, updates, and access permissions.

- Embrace the cloud for security. Take advantage of the secure storage space offered by cloud providers to make data less accessible to cybercriminals.

- Implement data-centric security by encrypting data and restricting access to sensitive information.

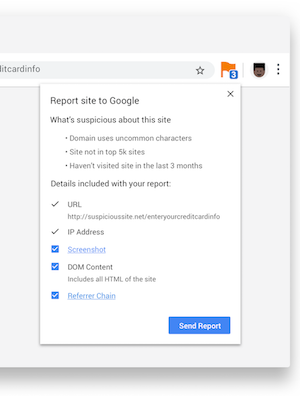

- Demand application security by design. Implement best security practices and test them often. With the continuing popularity of phishing, experts would recommend employee training in how to recognize attacks, followed by test fake attempts to evaluate response.

- Engage in proactive defense. A proactive defense includes a firewall, security software, and a strong virtual private network (VPN). The first two provide a protective perimeter that detects, blocks, and removes inbound malware and viruses. The latter creates an anonymous, encrypted internet connection that makes it harder for snoopers to find, intercept, or read data.

Saint Ambrose lost nearly $2 million as a result of the cyberattack, and may or may not get it back. The cost to prevent it could have been as simple as:

- A few hours of paid time for a cybersecurity consultant

- Employee training on how to not get phished

- A few hundred dollars’ worth of software (firewall, VPN, etc)

Related Content:

- 7 Recent Wins Against Cybercrime

- Cognitive Bias Can Hamper Security Decisions

- The Minefield of Corporate Email

Sam Bocetta is a freelance journalist specializing in U.S. diplomacy and national security, with emphases on technology trends in cyber warfare, cyber defense, and cryptography. Previously, Sam was a defense contractor. He worked in close partnership with architects and … View Full Bio