Some say we need a more consistent approach, while others worry a national law might supersede and water down some state laws already on the books.

The demand for a national data breach disclosure law is, in part, a broader topic about privacy management and regulation on a national basis. The United States’ approach to privacy management is largely industry-sector driven — and, as a result, mandates are fragmented.

At a fundamental level, we all have personal identities and, as an extension, digital identities. They can be thought of as personal possessions — basically, as assets. The fact that our identities can be misused makes them a potential liability, as well, creating the legal basis for harm, neglect, and damages. The point of a national data breach disclosure law is focused on promising a consistent approach that gives the public more assurance.

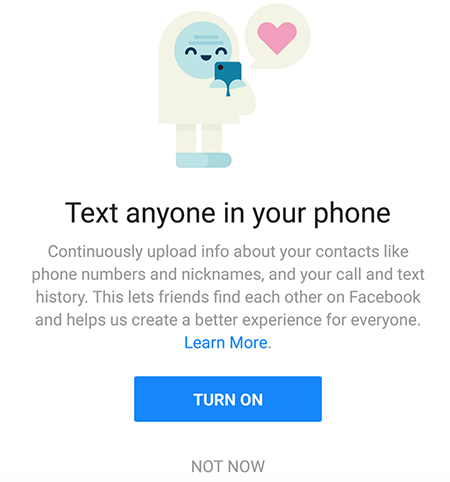

Modern consumers need more confidence in how their identities are used and managed on the Web, and they need reassurance that, when necessary, they will be notified so they can take actions to protect themselves from the dark side of the Internet world. The Internet is not inclined to protect the public, so laws are necessary.

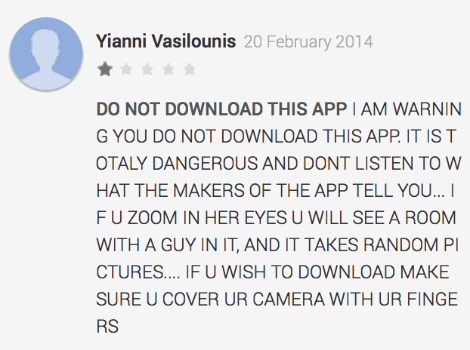

Identity, the protection of our identity, and what is the basis for privacy management is not a new topic, or something created by an out-of-control, artificial intelligence-driven computer society. Early writing on the topic includes “The Right to Privacy,” written by Samuel Warren and Louis Brandeis and published in an 1890 issue of the Harvard Law Review. At that time, a new technology, photography, was all the rage in claims of privacy invasion. A picture is — and will continue to be — personal identifiable information (PII). PII instantiates your identity, which in turn can be used to violate your privacy without your consent. However, as technology pushes endless boundaries, we find that principles and laws are strained to remain up to date and relevant.

Right now, the US does not have a national privacy management standard, per se, and certainly there is no uniform breach notification law. Instead, the United States treats the regulation of privacy as an industry-centric issue. We have healthcare laws that address privacy, but only when the privacy data is protected health information, a form of PII. We also have commercial credit laws mandated by the Consumer Credit Protection Act, enacted in 1968. Of course, there are other examples, which demonstrate that the federal government does not have a single, uniform approach.

Instead, the federal government has left this up to the states, creating a patchwork of laws. The National Conference of State Legislatures website depicts the wide ranging approach of the states. This creates a tremendous burden on the business community.

An Incentive Not to Report

In the US, an identity is compromised every two seconds. Globally, in 2017, 26.1% of all companies confidentially surveyed in the 2017 Thales Data Threat Report reported a breach, up from 21.5%. Across all companies worldwide, 67.8% confide that they have experienced a breach at one point. Within the US, that number is 73%. These numbers, startling or not, do not set aside the fact that companies have incentives not to report without a compliance mandate. Note the logic: if there is no penalty for failing to report a breach, why would a company want to report a breach? If nobody else knows, then damage to reputation, the cost to address the breach, and action against a company may be avoided. Without legal mandates, companies have incentives not to report.

In recent weeks, both retailers and financial services firms have called on the US Congress to create a federal data breach disclosure notification law that supersedes state data breach notification laws. They contend a federal standard would simplify compliance and make the threshold for disclosure clear to businesses and consumers alike. However, there are alternative views.

Some would argue that 48 states, the District of Columbia, Guam, Puerto Rico, and the Virgin Islands have enacted legislation already. Therefore, Congress need not rush in to fill a vacuum that does not exist.

Others, such as the American Bankers Association, argue that the patchwork approach, rules, criteria, response, and definition of terms are inconsistent, and put an ever-increasing burden on US businesses.

However, many of the states that have breach notification laws are concerned that a federal approach could supersede and reduce protections enacted to protect their state citizens. Remember, the states took action because the federal government failed to do so.

Some argue for a national law that would allow each state to enhance the protections. The net results, though well intended, may be even more convoluted.

Then there is the state revenue dilemma. Superseding state laws and invoking federal standards, rules, fines, and penalties would deplete revenue generated by state jurisdiction and venue for legal redress.

Others would continue the argument that a data breach depends on the nature and type of data. A healthcare breach is not the same as a financial system breach or a retail data breach. Those that trade in stolen identities might support this argument, noting that a compromised healthcare identity trades on the black market at a higher price premium than other compromised identity.

Here is what cannot be argued: your identity is an asset and, when violated, can be a liability that enables identity theft and general invasion of privacy. If I, as an individual, entrust my identity to the charge of another individual or entity, I have a reasonable expectation for responsible behavior. If an entity loses control over my identity, I have a reasonable expectation to be informed in a timely manner so that I, too, can take actions to mitigate the risks of any compromise and adverse outcome to my identity.

That starts with timely notification so that I can act defensively. There may be many perspectives on privacy, but there’s undeniably a need for timely breach notification.

Related Content:

Join Dark Reading LIVE for two cybersecurity summits at Interop ITX. Learn from the industry’s most knowledgeable IT security experts. Check out the Interop ITX 2018 agenda here.

Dallas Bishoff manages security consulting services for PCM. He is responsible for profit/loss, utilization, staff growth and capabilities, customer satisfaction, and both creation and oversight of standardized security offerings including: vCISO, GRC assessments, PCI … View Full Bio

Article source: https://www.darkreading.com/endpoint/privacy/privacy-do-we-need-a-national-data-breach-disclosure-law/a/d-id/1331325?_mc=rss_x_drr_edt_aud_dr_x_x-rss-simple

Did you see it?

Did you see it?